Smarter Hiring with Recruitment Data Analysis

- Talent People

- Jun 30, 2025

- 17 min read

Ever found yourself making hiring decisions based on a gut feeling? Recruitment data analysis is about swapping that guesswork for solid, evidence-based choices. It's the process of looking at your hiring data to figure out what’s actually working and, just as importantly, what isn’t. It helps you answer those crucial questions like, "Where do our best candidates really come from?" or "Why is this role taking so long to fill?"

What Is Recruitment Data Analysis Anyway?

Imagine your hiring process is a long road trip. Without a map, you’re bound to take wrong turns, hit dead ends, and burn through fuel. Think of recruitment data analysis as your GPS for this journey. It gives you a clear, data-backed route to finding and hiring great people, helping you navigate the tricky modern job market with confidence.

This isn't about becoming a data scientist overnight. It’s simply about moving from a reactive, instinct-led approach to a proactive, strategic one. When you dig into the numbers behind your recruitment, you start to see a story. This story can pinpoint hidden bottlenecks, show you which of your sourcing channels are goldmines, and ultimately save your organisation a serious amount of time and money.

Moving Beyond Guesswork to Strategy

Every hiring manager has been on the receiving end of tough questions from the board: "Why aren't we filling roles faster?" or "Are we spending too much on recruitment agencies?" Without data, your answers are just educated guesses. With data, they become facts.

Recruitment data analysis gives you the hard evidence you need to steer your strategy. It shines a light on your entire talent acquisition funnel, from the moment someone applies to the second they accept your offer. That kind of clarity lets you make small, precise tweaks that deliver real, measurable results.

For example, you might discover that:

Your best-quality hires consistently come from employee referrals, giving you a clear signal to invest more in your referral programme.

A specific stage in your interview process has a high drop-off rate, which tells you that you need to improve the candidate experience at that point.

The cost to hire for technical roles is creeping up, indicating it's time to explore new, more cost-effective sourcing channels.

Why Data Matters in Today's Market

The world of hiring is always changing, swayed by economic shifts and what's happening in the labour market. Relying on gut feelings just doesn't cut it anymore if you want to stay competitive. In a tight market, every single hiring decision counts, and any inefficiency can be incredibly costly.

Recruitment data analysis transforms your hiring from an art based on intuition into a science driven by evidence. It provides the framework for continuous improvement, ensuring your strategies adapt and succeed no matter the market conditions.

Recent UK labour market data shows this perfectly. Estimates for mid-2025 revealed that the number of payrolled employees fell by 55,000 (0.2%) between March and April 2025. This subtle shift points to a more cautious mood among employers and potential recruitment hurdles ahead. Having a solid handle on your own hiring data allows you to see these external trends for what they are and adjust your own strategy before it’s too late. You can dive deeper into these figures in the latest UK labour market bulletin on ONS.gov.uk.

The Recruitment Metrics That Actually Matter

Diving into recruitment data doesn't mean you need to get lost in dozens of complex figures. The secret is to focus on a handful of key metrics that tell the most important stories about your hiring process. These core numbers are your signposts, guiding you towards smarter, more effective decisions.

Think of it like a car's dashboard. You don’t need to know every single mechanical detail, but you absolutely need to see your speed, fuel level, and engine temperature. The same logic applies here. By mastering just a few essential metrics, you get a clear, actionable view of your recruitment health without feeling overwhelmed.

To really get to grips with what your data is telling you, it helps to understand what each key metric measures and, more importantly, what strategic questions it can help you answer.

Essential Recruitment Metrics and Their Business Impact

Metric | What It Measures | Key Business Question Answered |

|---|---|---|

Time to Fill | The total number of calendar days a specific role remains open, from approval to the new hire's start date. | How long does it take us to fill critical roles, and what is the impact on business productivity? |

Time to Hire | The speed of the recruitment process from the candidate's perspective, from their application to offer acceptance. | Is our hiring process fast and efficient enough to secure top talent before our competitors do? |

Cost per Hire | The total financial investment—both internal and external—required to recruit one new employee. | Are we investing our recruitment budget wisely, and which sourcing methods offer the best return? |

Quality of Hire | The value a new employee brings to the business, typically measured over their first 6-12 months. | Are our hiring efforts bringing in people who truly succeed and contribute to our long-term goals? |

Sourcing Channel Effectiveness | The performance of various recruitment channels (e.g., referrals, job boards, social media) in delivering successful hires. | Where are our best candidates coming from, and where should we focus our time and money? |

By tracking these core indicators, you move from simply filling jobs to strategically building a stronger, more capable workforce. Now, let's unpack these a bit more.

Time to Fill and Time to Hire

These two sound similar, but they tell very different stories.

Time to Hire is all about speed and efficiency once you've found your candidates. It tracks the days from when someone applies to when they accept your offer. A short Time to Hire usually points to a smooth, positive candidate experience.

Time to Fill, on the other hand, is the big-picture number that matters for business planning. It measures the total days a role sits empty, from the moment the job is approved until your new hire starts. A long Time to Fill can have a huge impact, leading to lost productivity and overworked teams.

What it tells you: A long Time to Fill can be a red flag. It might point to unrealistic job requirements, a broken interview stage, or compensation that isn't aligned with the market.

Simple Calculation: (Date New Hire Starts) - (Date Job Was Approved) = Time to Fill in Days.

Cost per Hire

This is the ultimate bottom-line metric. Cost per Hire calculates the total investment needed to bring a new employee on board. It’s a crucial number for justifying your budget and proving the financial efficiency of your hiring strategies.

To work it out, just add up all your internal and external recruitment costs over a set period (like a quarter) and divide that by the number of hires you made in that same timeframe.

Costs to include:

Recruitment agency fees

Job board advertising spend

Employee referral bonuses

Salaries of your internal recruitment team

Background check services

Understanding this number helps you answer questions like, "Are we leaning too heavily on expensive agencies?" or "Which of our sourcing channels gives us the best return on investment?"

Quality of Hire

This is arguably the most important metric, but it's also the trickiest to pin down. Quality of Hire tells you how valuable a new employee has become to the organisation. It directly connects your recruitment efforts to actual business performance.

A high Quality of Hire is the ultimate proof that your recruitment process isn't just filling seats—it's building a high-performing team that drives the company forward.

While there's no single magic formula, you can create a reliable score by combining a few key data points after a new hire has settled in for 6-12 months:

Performance Review Score: How well did they do in their first annual review?

Retention Rate: Are they still with the company after one year?

Hiring Manager Satisfaction: How happy is their manager with their performance?

Tracking this helps you see which sources deliver candidates who don't just get the job, but truly succeed in the long run.

Sourcing Channel Effectiveness

This metric answers a simple but vital question: "Where are our best candidates coming from?" Sourcing Channel Effectiveness breaks down which channels—like your company careers page, LinkedIn, employee referrals, or specific job boards—are actually delivering the hires.

This analysis becomes even more powerful when you combine it with Quality of Hire data. You might discover that while one job board brings in the most applications, employee referrals consistently result in hires who perform better and stay longer.

This is especially critical in a challenging market. UK employers are still finding it tough, with 33% reporting hard-to-fill vacancies. A significant 36% of HR professionals identify a shortage of skilled candidates as a key obstacle. In response, savvy companies are getting strategic: 47% are upskilling their current workforce, while 43% have raised pay to attract talent. By understanding which channels deliver, you can focus your resources where they will have the most impact. You can explore more of these HR statistics and trends at CV Genius.

How to Build Your Data-Driven Hiring System

Switching to a data-driven approach might sound intimidating, but it’s really just about taking one practical step at a time. Let’s walk through how to build your own recruitment analysis system from scratch. This isn't about needing a data science degree; it's a straightforward roadmap to move you from theory to real-world action.

It all starts with a simple question: "What problem are we actually trying to solve?" Without a clear goal, data is just a jumble of numbers. With a goal, it becomes your most powerful tool for making a real difference.

Step 1: Define Your Recruitment Goals

Before you even think about opening a spreadsheet, you need to be crystal clear on what success looks like for your team. Your goals have to be specific, measurable, and tied directly to a real business challenge. Vague ambitions like “hire better people” won’t get you anywhere.

Instead, get specific. Here are a few concrete examples:

Reduce our average time to fill for engineering roles from 60 days to 45 days within the next quarter.

Increase our offer acceptance rate for senior management positions from 75% to 90% over the next six months.

Decrease our reliance on external agencies by boosting hires from employee referrals by 25%.

By setting clear, measurable goals first, you give your recruitment data analysis a purpose. Every metric you track and every report you create should directly help you see if you're getting closer to these targets.

Step 2: Choose the Right Metrics to Track

With your goals in place, the next logical step is picking the metrics that show your progress. Resist the urge to measure everything. Just focus on the key performance indicators (KPIs) that connect directly to the goals you just set.

For instance:

Goal: Reduce time to fill.

Metrics to Track: Time to Fill, Time to Hire, and maybe Time in Stage (how long candidates are sitting in each part of your process).

Goal: Improve hire quality.

Metrics to Track: Quality of Hire (through performance reviews or manager satisfaction surveys) and First-Year Attrition Rate.

This focused approach stops you from drowning in data. It makes sure you’re only collecting information that leads to a specific, valuable outcome.

Step 3: Select Your Recruitment Analysis Tools

You don't need a fancy, expensive platform right out of the gate. The best tool is simply the one your team will actually use consistently. Your options run the gamut from simple to seriously powerful.

Spreadsheets (Excel or Google Sheets): Absolutely perfect for getting started. They’re free, flexible, and great for smaller teams tracking a handful of key metrics.

Applicant Tracking System (ATS): This is the engine room of modern recruitment. Most ATS platforms like Workable or Greenhouse have built-in analytics dashboards that automatically track metrics like source of hire and time in stage, saving you a ton of manual work.

Business Intelligence (BI) Tools: For deeper dives, tools like Microsoft Power BI or Tableau can pull data from your ATS and other HR systems. This lets you build comprehensive, interactive dashboards for leadership.

Start simple. A well-organised spreadsheet is far more effective than a powerful ATS that nobody knows how to use properly.

Step 4: Collect Clean and Consistent Data

This is, without a doubt, the most important step. Your analysis is only as good as the data you feed it. The old saying ‘garbage in, garbage out’ couldn't be more true here.

To keep your data clean, you need to set clear, consistent data entry rules for your team. For example, decide how everyone will record the source of a candidate. Is it "LinkedIn," "LI," or "LinkedIn Sourced"? Pick one format and stick to it. That consistency is what lets you run accurate reports down the line.

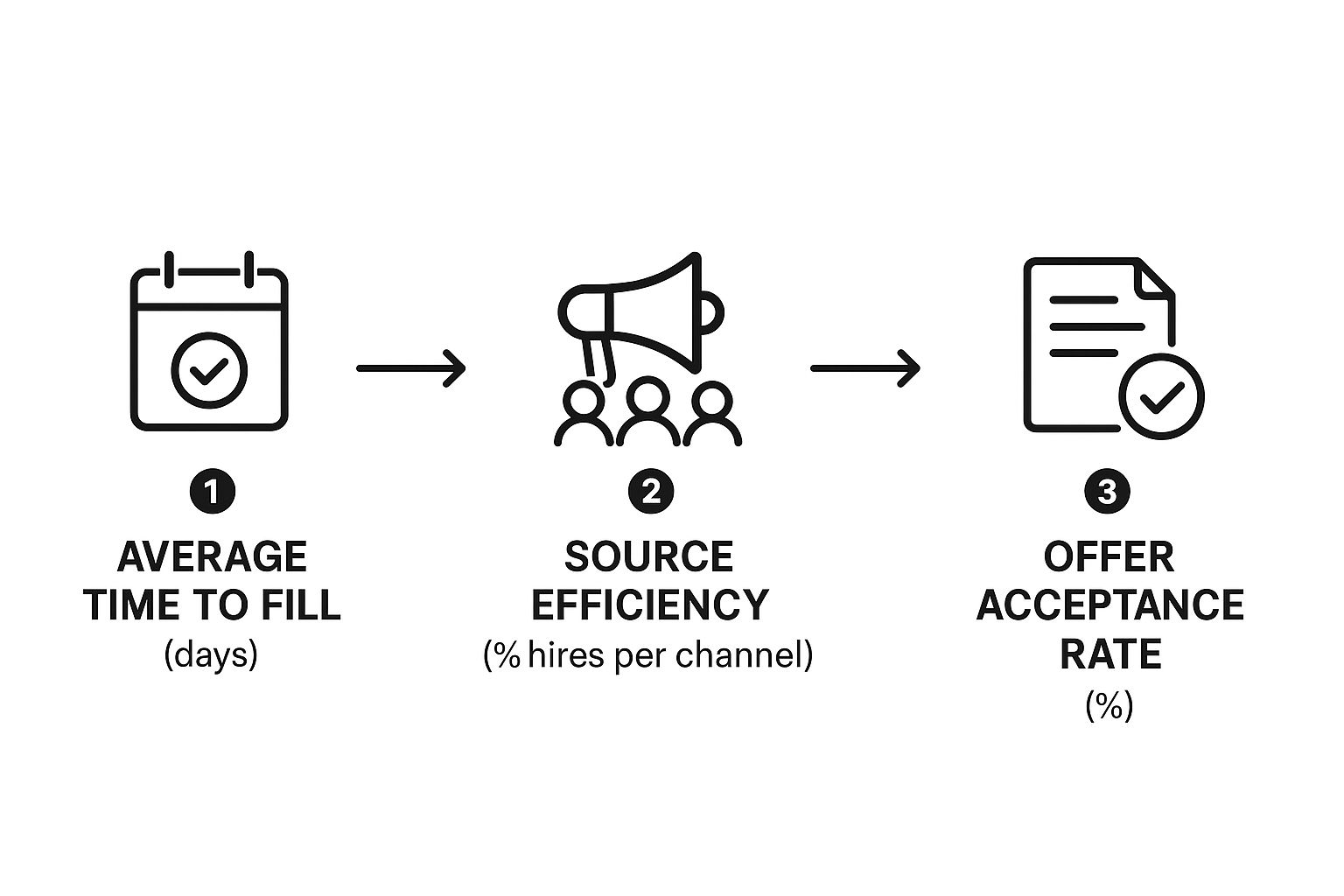

This flow shows how key metrics fit together to give you a clear picture of your hiring funnel’s health.

As the infographic shows, tracking time, source, and offer rates gives you a full view of your process from beginning to end.

Step 5: Analyse, Visualise, and Take Action

Now for the fun part: bringing your data to life. Raw numbers are tough to make sense of, but simple charts and graphs can tell a powerful story. Use your tool to create basic visuals, like a bar chart showing your top hiring sources or a line graph tracking your time to fill over the last year.

Share these insights with your hiring managers and leadership, not just as a report, but as a conversation starter. If your data shows that referrals bring in the highest quality of hire, the action is obvious: invest more in your employee referral programme. If you see a huge drop-off after the first interview, it’s time to dig in and figure out how to improve that stage of the candidate experience.

This cycle—define, measure, analyse, and act—is the heart of a successful data-driven hiring system. It turns recruitment data analysis from a boring reporting task into your engine for constant improvement.

Connecting Your Data to the Real World

Your recruitment efforts don't happen in a vacuum. They're constantly being shaped by the wider economic and labour market currents flowing just outside your office walls. This is where truly effective recruitment data analysis comes in—it’s about looking beyond your internal numbers to understand these external forces.

When you start connecting your own data with real-world trends, you gain a massive strategic advantage. It’s the difference between simply reacting to the market and getting ahead of it. This mindset shifts you from a manager who just fills roles to a leader who anticipates what's coming next.

Understanding the External Talent Landscape

Think of your internal data—like time to fill or cost per hire—as your car's speedometer and fuel gauge. They’re essential for telling you how your own engine is performing. But external market data? That’s your weather forecast and traffic report, warning you about the conditions you're about to drive into.

Ignoring this external context is like planning a long road trip without checking for storms or rush-hour traffic. Sure, you might have a full tank of fuel, but you could be heading straight for a standstill. Knowing about things like candidate availability, changing salary expectations, or new skill demands helps you adjust your route before you get stuck.

For instance, imagine there’s a sudden surge in available tech talent in your region. That single piece of information should completely change your game plan. Instead of shelling out for expensive headhunter fees, you can pivot your strategy to attract high-quality inbound applications. This is exactly how data-led hiring makes a direct impact on your bottom line.

How Market Shifts Should Influence Your Strategy

External market data provides vital clues that should trigger specific, strategic actions within your recruitment process. When you spot a trend, you can make informed decisions instead of panicked guesses.

Here are a few practical examples of how this plays out:

When data shows a talent surplus: If the market is flooded with qualified candidates, your focus should shift from aggressive sourcing to efficient screening. This is the perfect time to optimise your inbound channels and let your ATS handle the high volume of applications without burning out your team.

When data points to a skills shortage: Let's say you see high demand but low supply for a specific role, like renewable energy engineers. You know the competition will be fierce. This signal tells you it might be smarter to invest in upskilling your current employees or start building a long-term talent pipeline.

When salary expectations are rising: Market data is brilliant for benchmarking your pay against competitors. If you see salaries for a role climbing, you can proactively adjust your compensation packages to stay in the game and improve your offer acceptance rate.

By learning to read these external signals, your recruitment function becomes a strategic partner to the business. You start providing insights that inform workforce planning, budgeting, and the company's overall direction. You’re no longer just hiring; you're future-proofing the organisation.

Recent trends in the UK job market show just how crucial this is. A report from April 2025 revealed a noticeable drop in the demand for new staff, with the Total Vacancies Index falling from 44.2 to 43.1. At the same time, the supply of available candidates shot up, marking the fastest increase since late 2020. Understanding this shift allows savvy recruiters to immediately adjust their spending and strategy. You can dive into the full UK job market report from Prism Recruitment to get more details on these trends.

Ultimately, this kind of contextual recruitment data analysis is what separates good hiring from great hiring. It ensures your strategy is always relevant, responsive, and ready for whatever the market throws at you next.

Common Mistakes That Can Derail Your Analysis

Jumping into recruitment data analysis is a fantastic move, but the real trick is making it stick. It's one thing to know the 'how-to', but it's the 'how-to-do-it-right' that turns a short-lived data project into a genuine, high-impact hiring strategy.

Think of it like this: knowing the common pitfalls ahead of time lets you build a smarter, more resilient system from the very beginning. Let's walk through the classic blunders teams make and, more importantly, how you can sidestep them to get real value from your efforts.

1. Overlooking Data Quality

This is the big one. If you get this wrong, everything else falls apart. The old saying ‘garbage in, garbage out’ is brutally honest, especially in recruitment. When your data is a messy, inconsistent jumble, any "insight" you find is just a mirage. It could easily point you in the completely wrong direction.

Imagine half your team logs a candidate source as “LinkedIn” while the other half types in “LI.” Your report on source effectiveness is now totally skewed. You might think LinkedIn isn't pulling its weight, but the real problem is just fragmented data.

Here’s how to get it right:

Set clear ground rules: Create a simple guide for your team. How should they log sources? What are the standard job titles? Agree on a consistent set of rejection reasons.

Do a quarterly clean-up: Set aside a little time every few months to scan your data for obvious errors and inconsistencies. A quick tidy-up now saves you from a massive analytical headache later.

Let your tools do the work: Use your Applicant Tracking System (ATS) to automatically capture things like application dates. This drastically cuts down on human error.

2. Focusing on Vanity Metrics

It's so easy to fall for numbers that look great on a slide but mean absolutely nothing for the business. A huge spike in applications might feel like a victory, but if 99% of those people aren't qualified, it’s not a win—it’s just a mountain of noise for your team to sift through.

Don't chase these feel-good numbers. Instead, always connect your analysis back to tangible business goals. Stop tracking just the number of candidates and start measuring the Quality of Hire that comes from each source. That’s a metric that actually matters.

True success in recruitment data isn't about having the biggest numbers; it's about having the right numbers. Zero in on the metrics that directly point to hiring speed, cost savings, and the long-term success of the people you bring on board.

3. Keeping Data Locked Away in a Silo

Data gains its real power when it's shared and understood by everyone. A classic mistake is for the recruitment team to hoard all their findings. When you don't share what you've learned with hiring managers or the leadership team, you miss a massive opportunity to actually improve things.

Let's say your data clearly shows that roles with vague job descriptions take 30% longer to fill. If you keep that stat to yourself, nothing will ever change. But if you share that specific insight with hiring managers, you give them the information they need to write better, clearer job descriptions. Suddenly, you're all working together to hit your targets.

4. Neglecting Data Privacy and Ethics

In the excitement of digging into data, it’s vital not to forget about ethics and privacy. You're handling people's personal information, and that comes with a serious responsibility, especially with regulations like GDPR in the UK and Europe.

A failure to protect candidate data can land you in serious legal trouble and do lasting damage to your employer brand. Make sure your recruitment data analysis is built on a foundation of respect.

Practise data minimisation: Only collect what you truly need. If it’s not essential for your analysis, don’t ask for it and don’t store it.

Be transparent with candidates: Your privacy policy should clearly and simply explain how you use their data. No jargon, no hiding in the fine print.

Anonymise your analysis data: When you're building reports to spot trends, strip out all personally identifiable information. You're analysing patterns, not people.

By thoughtfully avoiding these common traps, you can be confident that your analysis is not just accurate and insightful, but also responsible and sustainable. This is how you build a data-driven culture that truly elevates the way you hire.

Your Recruitment Data Questions Answered

Diving into data-driven hiring often sparks a few questions. It’s natural to wonder if you need fancy tools or a background in statistics to make it work. The good news is, you don't. Let's clear up some of the most common queries and show you how straightforward it can be to get started.

Where Do I Even Find My Recruitment Data?

Chances are, your recruitment data is already at your fingertips, just spread across the different tools you use every day. You don't need one big, expensive system to start gathering insights; you just need to know where to look.

Your Applicant Tracking System (ATS) is the best place to start. Think of it as a goldmine of information, packed with details on where candidates came from, application dates, and how they progress through your hiring stages.

But don't stop there. Other valuable sources include:

Your company's Human Resources Information System (HRIS), which holds key data on the people you actually hire.

Performance reports from any recruitment agencies you work with.

The analytics dashboards on job boards like LinkedIn, which tell you how your job adverts are performing.

Even the humble spreadsheets your team uses to track applicants or interview schedules can be incredibly useful.

The most important thing at the beginning isn't having a perfect, centralised system. It’s about being consistent in how you collect and label the information you already have.

Do I Need to Be a Data Scientist for This?

Absolutely not. This is probably the biggest myth holding people back from recruitment data analysis. At its core, this is about asking smart questions about your hiring process, not about running complex statistical models.

If you know how to work out an average in a spreadsheet, you have all the technical skills you need to begin. Start with simple but powerful metrics like Time to Fill and Cost per Hire. These calculations are straightforward and can uncover some seriously eye-opening insights without any advanced maths.

Many modern ATS platforms are built to do the heavy lifting for you. They often have simple, visual dashboards that automatically translate your raw data into an easy-to-understand story about your hiring. All you need to bring is your curiosity.

How Does This Help with Diversity and Inclusion?

Data is one of your most powerful allies in turning good intentions about diversity into real, measurable progress. It gives you a clear, objective lens to see where you can build a more equitable and inclusive team.

By analysing your hiring funnel, you can pinpoint potential bias with surprising accuracy. For example, are you noticing a sharp drop-off of candidates from a particular demographic between the application and first interview stages? Data points you directly to the problem area, removing the guesswork.

This lets you move beyond vague commitments and make targeted, evidence-based improvements. Whether that means rewriting job descriptions to use more inclusive language or offering unconscious bias training to a specific interview panel, data ensures your efforts create a genuinely fair process for everyone.

How Often Should I Check My Recruitment Data?

There's no one-size-fits-all answer here. The right rhythm for checking your data really depends on what you're trying to accomplish. The trick is to match your review schedule to your goals.

It helps to think about it on two levels:

Strategic Review (Monthly or Quarterly): This is for your big-picture thinking. Use this time to track progress against major goals, like improving your overall Quality of Hire or lowering your annual Cost per Hire. These are the insights you’d take to leadership meetings to discuss long-term strategy.

Operational Check-in (Weekly): This is for managing the day-to-day. A weekly look at the numbers is perfect for monitoring a live job advert's performance or keeping an eye on the Time to Fill for an urgent role. It allows you to make quick adjustments that can have an immediate impact.

The key is to build a regular habit that works for your team. When recruitment data analysis becomes a consistent part of your routine instead of an occasional task, you embed it into your culture and drive continuous improvement.

At Talent People, we believe that data-driven insights are fundamental to building high-performing teams in competitive markets. Our project-based hiring solutions are designed to give you the strategic clarity you need to scale effectively. Whether you're entering a new market or resourcing a critical project, we help you make every hire count.

Discover how our agile recruitment partnerships can accelerate your growth.

Comments